An accidental fire can be one of the most traumatic experiences for a home or business owner—and it is often the most costly type of property damage. In a matter of minutes, everything can be lost. Fire losses range from light to severe damage, and most policyholders lack the expertise required to properly document the full extent of the loss.

Even a small fire can result in extensive smoke damage, impacting walls, ceilings, HVAC systems, and personal property. Proper training in smoke abatement and damage evaluation is critical to accurately demonstrate the true scope of loss.

Time Is Critical After a Fire

After a fire occurs, time is of the essence. There is significant work that must be done immediately to protect your claim. Hiring a professional Public Adjuster as soon as possible helps ensure the claim is handled efficiently and correctly from the start.

A skilled public adjuster is proactive—not reactive—often providing documentation to the insurance carrier before it is even requested. This approach helps prevent delays, underpayments, and missed coverages.

Understanding Fire Loss Coverage

It is crucial to have a professional advocate who can properly document the actual amount of loss sustained under each applicable coverage.

Hurry-Claim Public Adjusters does not charge a fee for Coverage D, yet we fully assist policyholders in collecting all eligible Additional Living Expenses (ALE) or Fair Rental Value. This includes the cost of living elsewhere while your property is uninhabitable or rental income lost during repairs.

How Hurry-Claim Public Adjusters Handles Fire Claims

We work exclusively for the policyholder, never the insurance company. Our goal is to ensure no detail is missed.

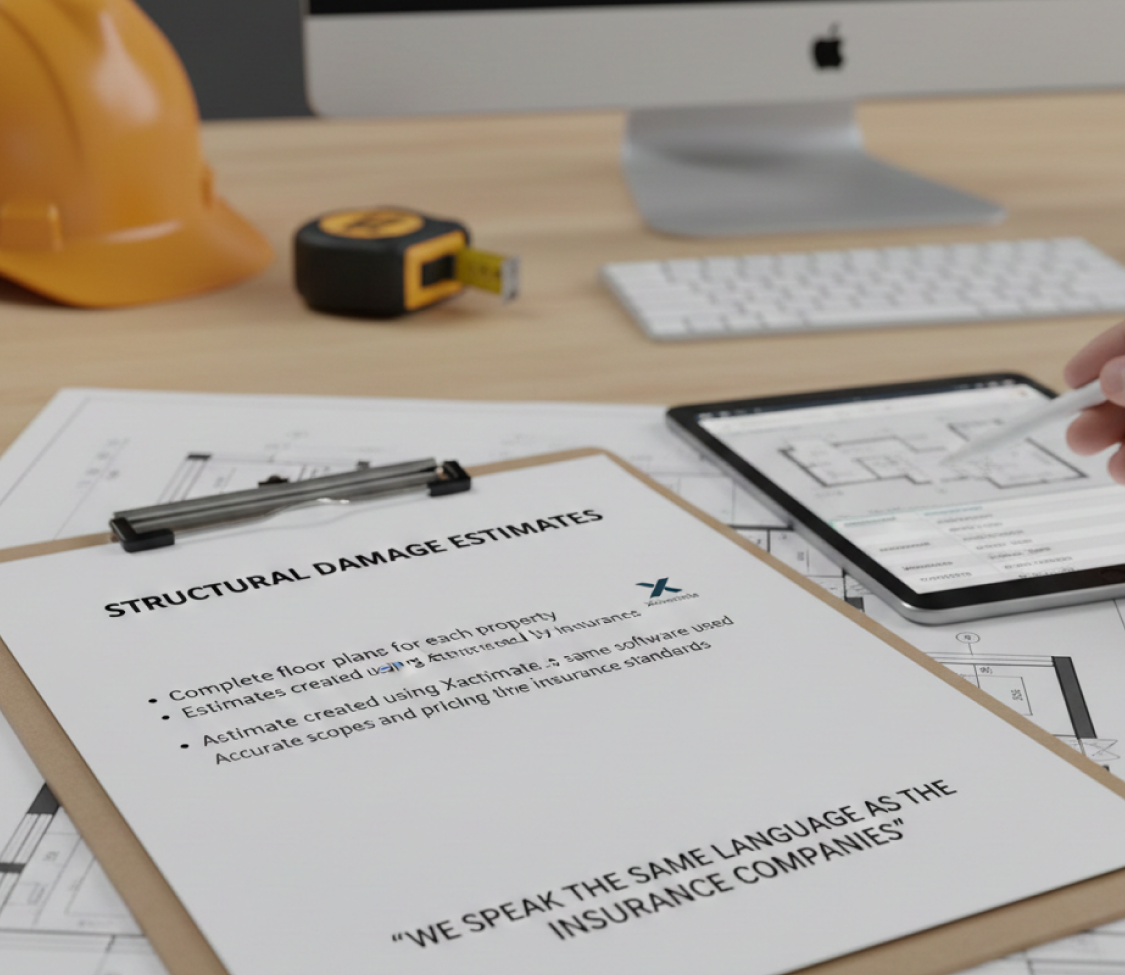

Structural Damage Estimates

This approach eliminates inconsistencies commonly found in contractor estimates, which can vary widely. .

“We speak the same language as the insurance companies.”

Personal Property Inventory

A comprehensive personal property inventory is created through extensive on-site documentation of all affected contents within a home or business.

All information is organized into a clear, professional spreadsheet.

Claim Submission & Approval

This ensures accuracy, transparency, and confidence throughout the claims process.