Wind damage can be caused by a variety of weather events, including hurricanes,

tornadoes, and severe thunderstorms. In Florida, weather conditions are often

unpredictable, with sudden storms forming frequently throughout the year. As a result, property damage is common—particularly to roofing systems—which can allow water to penetrate the interior of a home or commercial building.

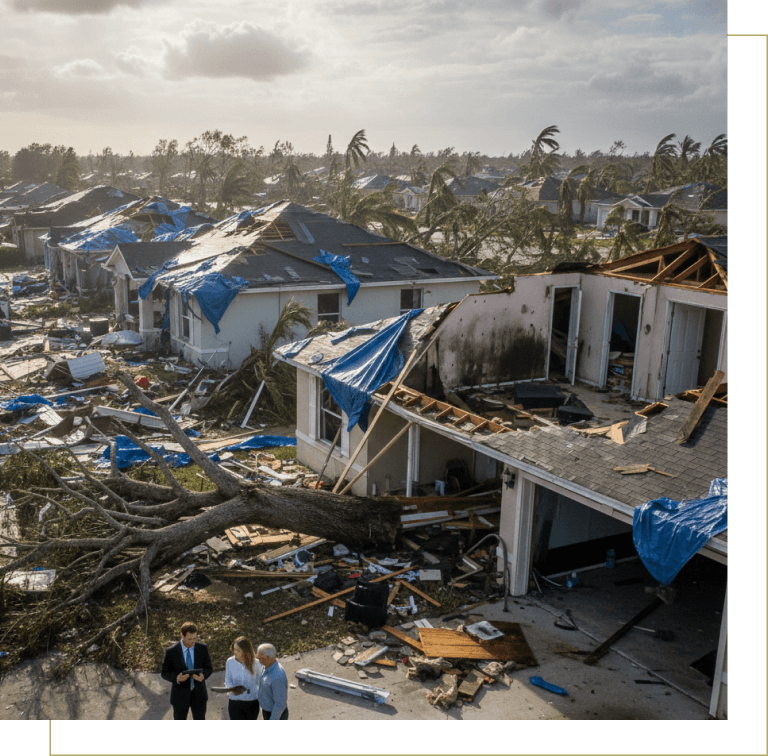

Hurricanes are especially devastating, often impacting entire regions at once. Following a major storm, it is critical for policyholders to seek professional representation as soon as possible. Recent legislative changes have significantly reduced the amount of time allowed to dispute an insurance claim. Due to these shortened deadlines, we strongly recommend hiring a Public Adjuster early in the process to maximize the potential for a

proper and fair recovery.

In many cases, wind or hurricane damage is not immediately apparent. Policyholders may not notice issues until stains appear on interior ceilings or walls. These stains can emerge immediately after a storm—or weeks or even months later—once hidden damage has worsened.

As Public Adjusters, we specialize in identifying both visible and concealed damage and preparing comprehensive claim files designed to achieve the best possible outcome. With extensive knowledge of Florida’s storm history, we can help link documented damage to specific wind or hurricane events that affected your area.

Before any inspection, wind and hurricane deductibles must be carefully reviewed to determine the viability and scope of a potential claim. Understanding these deductibles is a critical first step in the claims process.

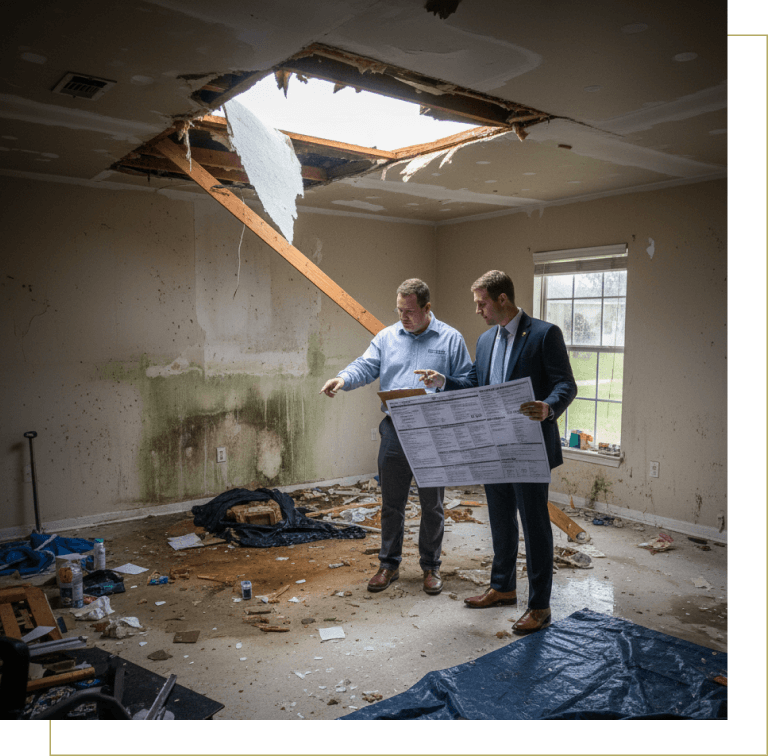

We assist policyholders in satisfying the burden of proof, which is a requirement under the insurance policy. This includes thoroughly inspecting every component of the roofing system, documenting all potential wind-related damage through detailed photographs and reports. We also inspect the entire property, including exterior walls, fencing, sheds, and other structures, to ensure no related damage is overlooked.

Based on our findings, we prepare a comprehensive structural estimate that may include roof repairs or replacement, exterior damage, and interior restoration.

Insurance policies have changed dramatically in recent years and must be reviewed in their entirety. We offer a no-obligation policy review at no cost to the policyholder. Many policies now include specific limitations or exclusions related to hurricane damage. For example, exterior paint or waterproofing may not be covered under certain policies. Understanding these limitations is essential when valuing a claim and demonstrates how an experienced Public Adjuster can streamline and expedite the claims process.

Accounting for depreciation is another critical component of effective claims adjusting. Proper depreciation analysis can significantly impact both the immediate claim outcome and any future recovery.