Mold coverage is typically triggered only after a covered loss has occurred and is usually limited or capped under most insurance policies.

For the best possible recovery, it is crucial that the insurance claim is handled by a licensed Public Adjuster with experience in mold-related claims.

If mold is suspected in a property, all activity must stop immediately, and a licensed Hygienist specializing in mold testing should be contacted. Our office can refer qualified hygienists to our clients when needed. Mold testing results are typically accompanied by a detailed remediation protocol, which outlines the proper methods for safely removing mold from the property.

In most residential insurance policies, mold coverage is capped at approximately

$10,000, although coverage amounts may vary if the policyholder has purchased

additional endorsements or mold-specific coverage.

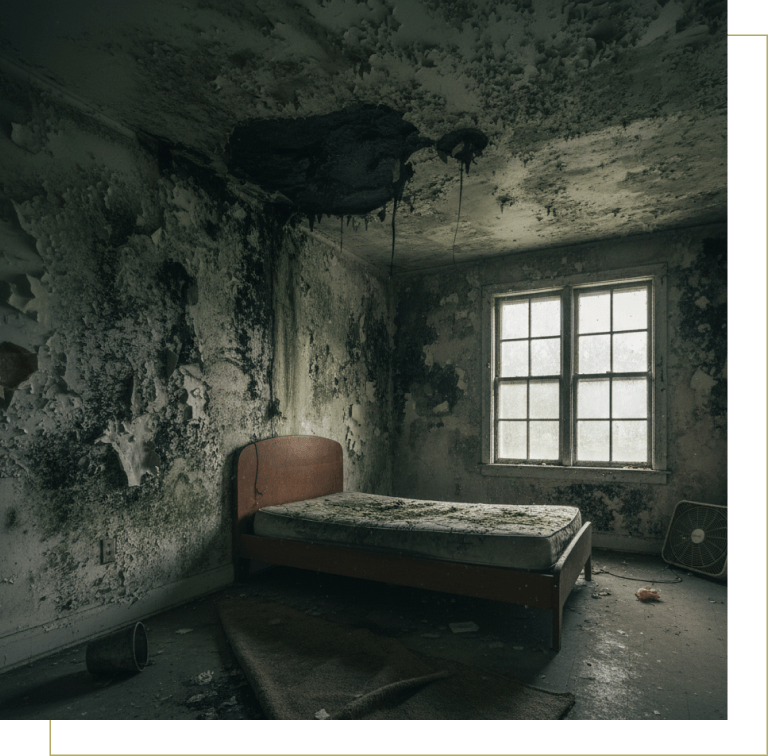

Addressing mold as soon as it is discovered is critical. If not handled correctly and

promptly, mold can spread rapidly and uncontrollably, affecting entire areas of the property and the contents within them.